Yes, it is time to be in cash (in my opinion). Some anecdotes and opinions follow:

https://www.yelpeconomicaverage.com/yea-q1-2020.html Lots of gems in there, too much to discuss in a thread without basically replicating the report. Two key points that I would like to highlight: first, people in most of the U.S. radically changed their behavior, curtailing trips outside the home weeks ahead of any stay at home order. Second, a lot of the business closures from the lockdown were permanent.

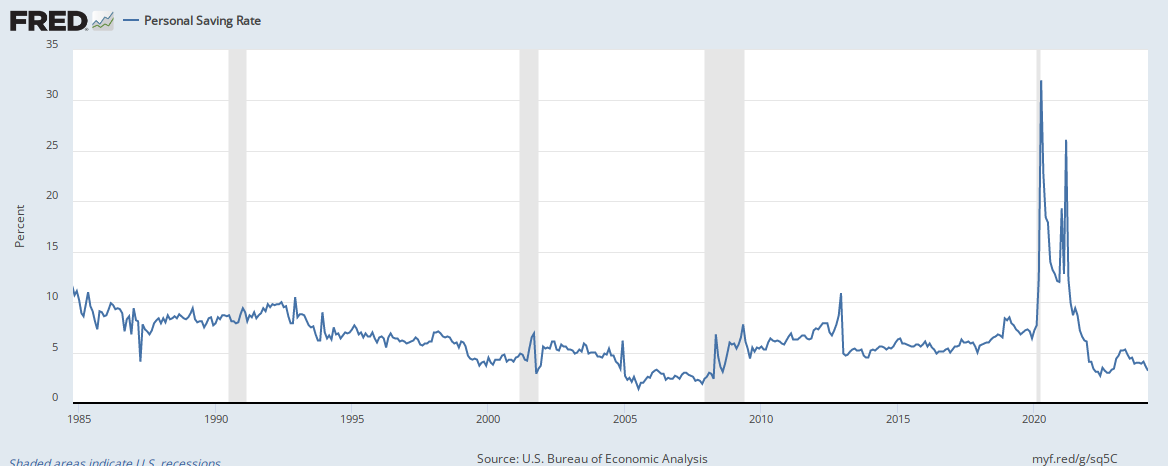

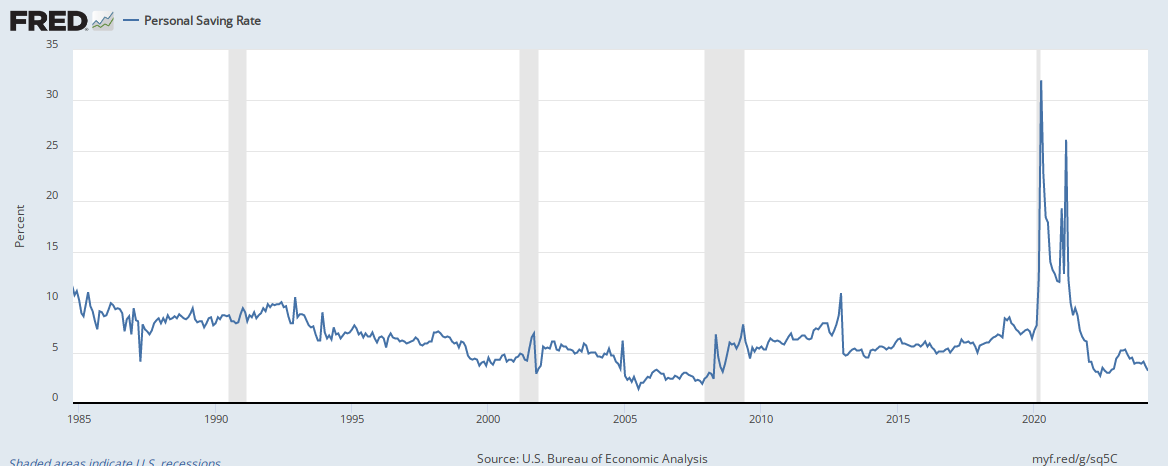

The next thing I would point to is the personal savings rate

That move literally breaks the chart. We'll see where it settles but I believe it will remain persistently high. I believe we've entered into what Richard Koo calls a "balance sheet" recession: a phase in which households and private corporations wish to de-lever. Doing so reduces income. This cycle feeds on itself unless reversed. Further, our reactionary monetary policy has pushed the rate of return on risk-free (or even "low risk") assets to near-zero (this was the correct policy response). So now the expected rate of return going forward is even lower thus the increasing the present rate of savings (no way to make 5% on your money tomorrow thus the need to spend less and save more today).

"But Green, the stock market isn't the economy!" you say

That's true. It's not. However there's essentially no difference at this point in owning investment grade debt and holding cash. That leaves junk debt and equities. Within the junk market you could loan to own (if you're big and smart), sift through the junk to find the companies that will survive (if you're smart), or you could just blindly bet on the Fed stepping into the junk market. Which might happen... but know it's a bet.

That leaves equities where most of the market value is vested in a handful of companies. Said companies have very solid balance sheets and market positions but their profitability is potentially exposed to regulatory action. The future of the rest of the publicly traded companies is very much in question. The Fed can fix liquidity but it can't fix bad credit. Could the Fed buy equities? Sure, and I think they will at some point. However that day is not today and it will not happen until the Fed has 1.) a reason... like a crash... and 2.) political clarity. One of the ways I could see the Fed buying equities, btw, is by lending money to pensions at very low rates over very long time horizons (e.g. a ZCB century bond) and letting pensions bid up equities. Again, don't expect that response anytime soon.

That leaves us with policy risk to equities going forward. What are some likely policies we'll see post 2020? Higher corporate and personal income taxes? Probably. Will things with China get any better? Almost certainly not. Domestic increases to minimum wage? Likely. Domestic environmental initiatives? Likely. Somewhat on-balance I think some sort of universal, single-payer healthcare is actually likely which partially offsets the prior negatives for corporate profitability (outside of healthcare). Also, significant infrastructure investment should help employment and aggregate demand recover.

I'm in cash for the foreseeable future.