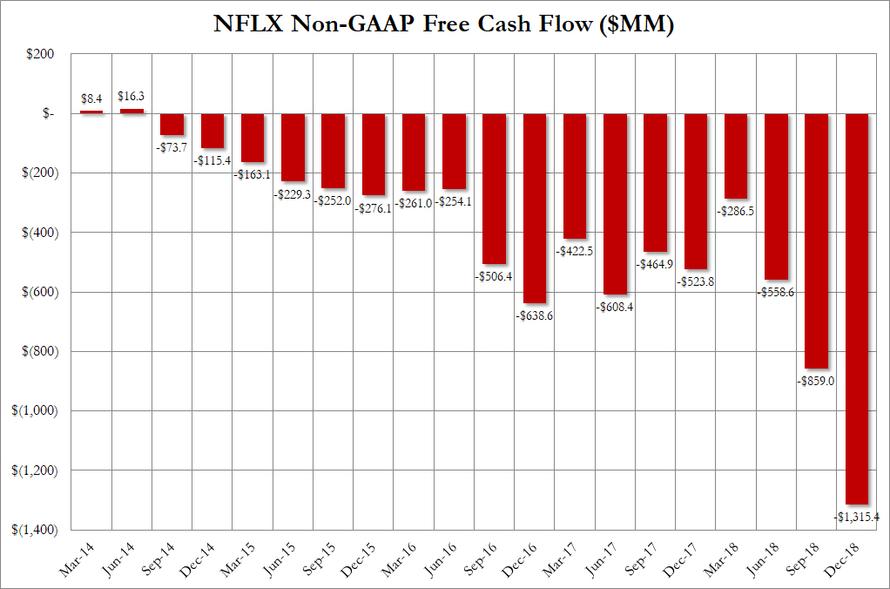

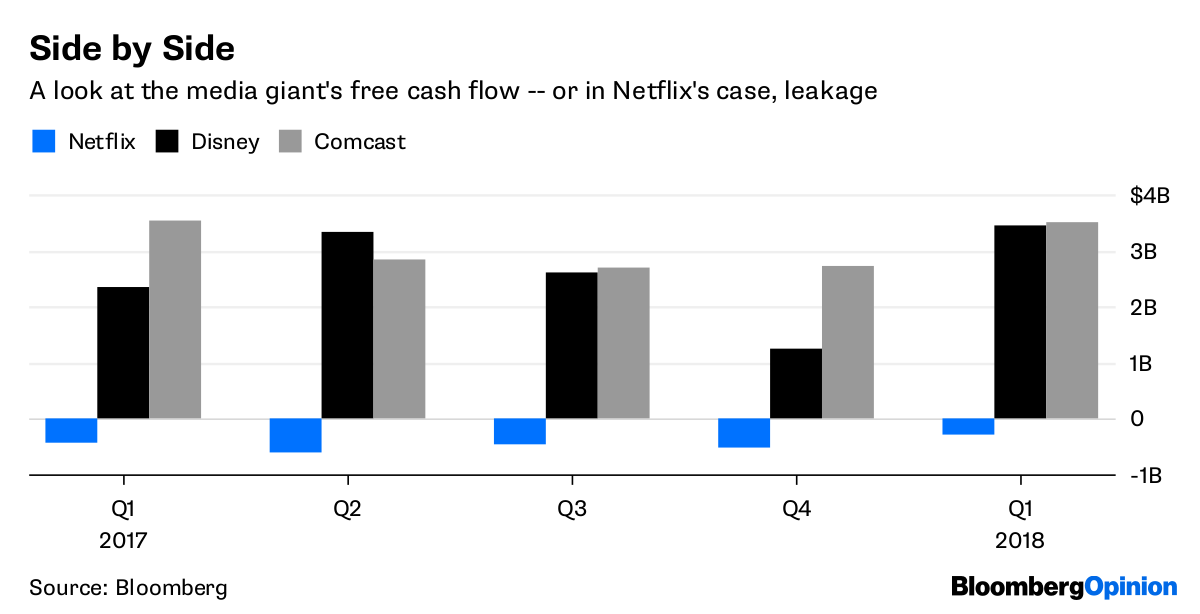

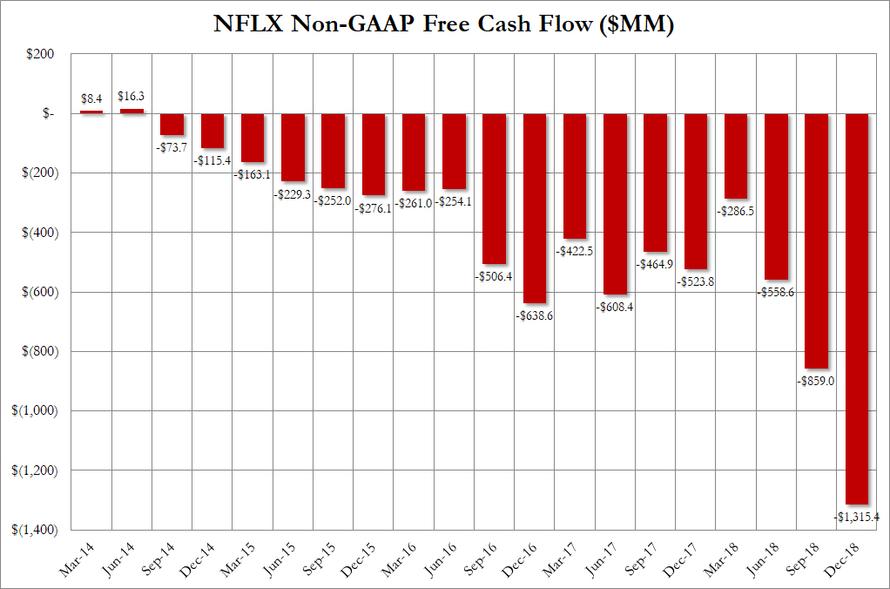

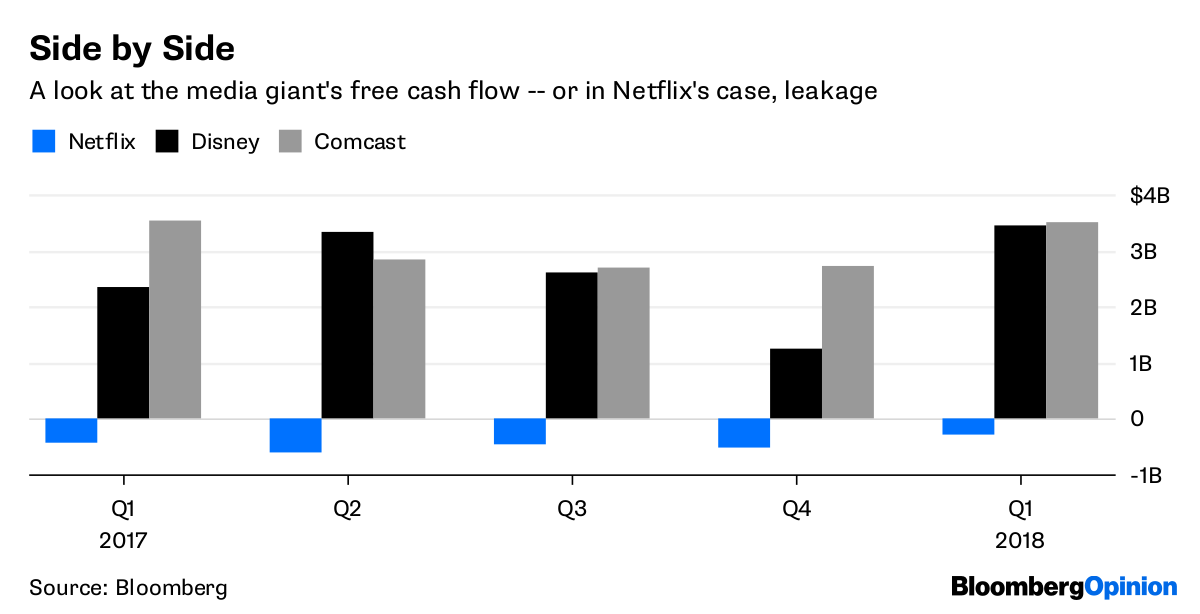

Something that article didn't mention is Netflix's off balance sheet debt obligations. Look, there's a reason that Netflix has shown positive earnings but negative free cash flow for a long time now....

The reason? Their content amortization assumption is faulty. Ever notice how Netflix is extremely cagey about giving out granular data for the viewership of specific shows/movies? That's because if they did people could figure out the proper rate at which Netflix should be amortizing their content obligations.

Here's how this scam works: to make things simple, let's say Netflix licenses Movie X for ten years and that's the only content Netflix has for that time period. The movie just released so lots of people want to watch it. Out of the total number of times Movie X is viewed on Netflix in its ten year life on the platform, perhaps 80% of the views will occur in the first year. If Netflix were to amortize that content straight line (they don't), they'd show huge earnings in year one. What happens in year two? Well, people don't want to watch Movie X so they cancel their subscription decreasing revenue. The same happens in year three, four, five... however the amortization remains constant so what was once a large profit quickly turns into a loss. By the end of year ten it's entirely possible that Netflix spent more licensing and distributing Movie X than it earned over that time period.

Netflix hides this quite well by always adding new content (and taking on debt to do so) and growing its subscribers. They don't use straight-line amortization but they also (likely) don't accelerate the amortization of their content obligations commensurately with viewership of said content. Doing so allows them to show significant positive earnings even though they have negative free cash flow. It's a bit of a Ponzi scheme that the credit markets let them get away with so long as there is growth. If Netflix ever hit a rough patch where it saw a hiccup in its subscriber base it would likely be classic case of stairs up, elevator down.

The reason? Their content amortization assumption is faulty. Ever notice how Netflix is extremely cagey about giving out granular data for the viewership of specific shows/movies? That's because if they did people could figure out the proper rate at which Netflix should be amortizing their content obligations.

Here's how this scam works: to make things simple, let's say Netflix licenses Movie X for ten years and that's the only content Netflix has for that time period. The movie just released so lots of people want to watch it. Out of the total number of times Movie X is viewed on Netflix in its ten year life on the platform, perhaps 80% of the views will occur in the first year. If Netflix were to amortize that content straight line (they don't), they'd show huge earnings in year one. What happens in year two? Well, people don't want to watch Movie X so they cancel their subscription decreasing revenue. The same happens in year three, four, five... however the amortization remains constant so what was once a large profit quickly turns into a loss. By the end of year ten it's entirely possible that Netflix spent more licensing and distributing Movie X than it earned over that time period.

Netflix hides this quite well by always adding new content (and taking on debt to do so) and growing its subscribers. They don't use straight-line amortization but they also (likely) don't accelerate the amortization of their content obligations commensurately with viewership of said content. Doing so allows them to show significant positive earnings even though they have negative free cash flow. It's a bit of a Ponzi scheme that the credit markets let them get away with so long as there is growth. If Netflix ever hit a rough patch where it saw a hiccup in its subscriber base it would likely be classic case of stairs up, elevator down.

Last edited by:

GreenPlease: May 24, 19 23:00