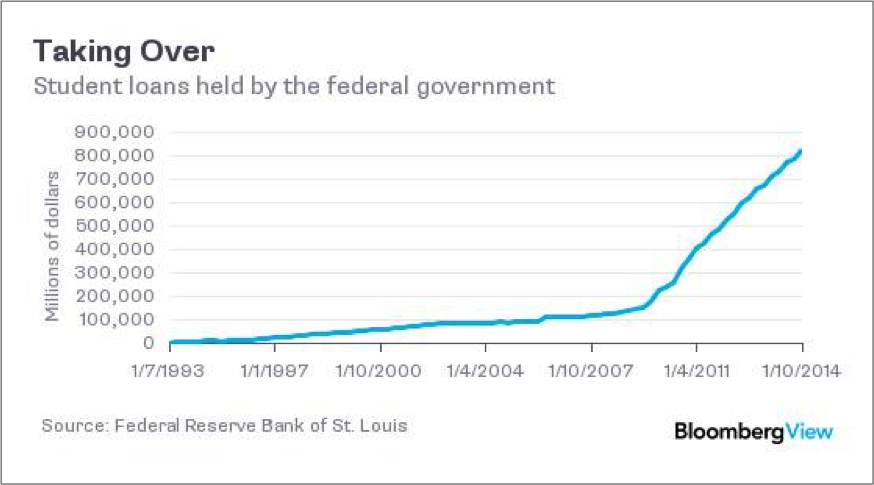

It will be interesting/scary to see what happens to the student loan and credit card debt that just keeps accumulating:

"It took nearly a decade, but debt has made a comeback.

Americans have now borrowed more money than they did at the height of the credit bubble in 2008, just as the global financial system began to fall apart.

The Federal Reserve Bank of New York said Wednesday that total household debt had reached a new peak â $12.7 trillion â in the first three months of the year, another milestone in the long, slow recovery of the United States economy.

One of the big drivers of the latest debt binge has been student loans, whose mounting burden can prevent Americans from buying homes or spending on big-ticket items, stifling economic growth.

The fear is that growing debt from student loans â as well as auto loans and credit cards â could put many Americans back in a hole, triggering a new wave of defaults, much like what happened in the mortgage meltdown a decade ago."

https://www.nytimes.com/...ted-states.html?_r=0

"The great pleasure in life is doing what people say you cannot do."

"It took nearly a decade, but debt has made a comeback.

Americans have now borrowed more money than they did at the height of the credit bubble in 2008, just as the global financial system began to fall apart.

The Federal Reserve Bank of New York said Wednesday that total household debt had reached a new peak â $12.7 trillion â in the first three months of the year, another milestone in the long, slow recovery of the United States economy.

One of the big drivers of the latest debt binge has been student loans, whose mounting burden can prevent Americans from buying homes or spending on big-ticket items, stifling economic growth.

The fear is that growing debt from student loans â as well as auto loans and credit cards â could put many Americans back in a hole, triggering a new wave of defaults, much like what happened in the mortgage meltdown a decade ago."

https://www.nytimes.com/...ted-states.html?_r=0

"The great pleasure in life is doing what people say you cannot do."