Wow that’s quite the drop from 2017. And I bet there are more old Zipp wheels out there on their last leg than old DT wheels.

“Zipp owns…” could very well be “Zipp rapidly dropping…”

Wow that’s quite the drop from 2017. And I bet there are more old Zipp wheels out there on their last leg than old DT wheels.

“Zipp owns…” could very well be “Zipp rapidly dropping…”

but in fairness its not so much tha tthe lead is shrinking its about having lost half its total market share in 7 years . going roughly from 50 percent to 25 percent of the market share and hookless so far does not seem to be the answer for them thats not just shringking thats a landslide.

i would think the bigger issue is that a lot of big bike companies have their own in house wheel brands now

and in a way i would say dt swiss s more important way to go up was to collaborate with swisside and change from a not so innovative aero wheel company into a innovative one by putting their label on swisside rims .

and to add companies selling more bikes with races wheels specked .

Time will tell that’s for sure. One thing to always keep in mind is that when it comes to the age group count. It’s the fruit of the past labors that are now showing up. DT Swiss started to bring those OEM Relationships last year and with D2C those show up way quicker then someone purchsing after the fact. Zipp has done a sub pair job the last couple of years in relation to marketing and inovation the same with ENVE. Shimano has done innovation but crap for marketing wheels and to your point. Carbon wheels are easier to make and bike companies have started to OEM Stock their own and those buyers now have “Good enough” wheels to ride on. These companies are relearning that valuable lession. Triathlon is ENDURANCE sports so the moment you dont spend money, time and energy marketing and connecting with your customer in triathlon you will loose the Endurnace athlete as a customer. They all went to GRAVEL only for markerting and customer communcation and left traithlon. Well guess what? All the new gravel cyclists are triathletes ( endurance athletes first) and they know these companies pulled away from triathlon so they are like… #screwyou becuase they like to match and the baseline of matching for them is in triathlon.

Do we have a count from Nice? It would be interesting to see how the distribution differs compared to the women’s racers. I would bet the more “budget” wheels make up a larger percentage

There is that Q3 report that shows Shimano sales down (but Garmin up), and I have to wonder how much of that is related to Shimano making great engineered products that miss the mark consumer-emotion-wise: see 2x vs 1x and 24mm vs 30mm bb spindle, and great engineered but ?unsexy? wheels. Not sure.

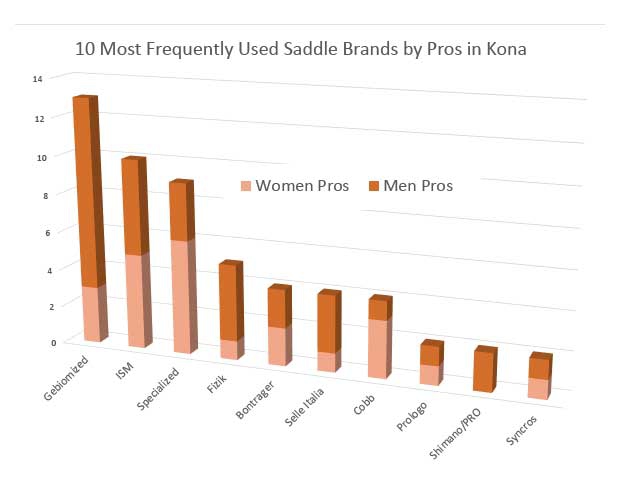

Waiting for an update to this 2022 count of pro men’s saddles ![]() There’s a Popular New Tri Saddle - Slowtwitch News

There’s a Popular New Tri Saddle - Slowtwitch News

What? DT has been OEM on multiple European brands for many many years now.

And I don’t follow the logic on this one. While a few people change their DT wheels to Zipp, in the meantime more people will buy new bikes. The data above already incorporates this time lag.

I doubt Zipp will recover to their past auccess in road/tri. In my circles, only 50+ year old athletes still talk about it as a desirable brand. The younger ones follow the data more than branding. Zipp is just not the performance choice anymore and it looks even worse when you add $ in the denominator.

Totally! If that drop is a projection of a similar drop in overall market share, that could easily mean that Zipp is going belly up, i.e. SRAM will need to move that trend in an opposite direction, if they want to see that subbrand survive.

In Europe I can say that I see a brand like DT Swiss (say 80mm rims) with offers at online retailers at half the price I would have to put down for an inferior Zipp wheel.

Zipp has some of the best value in terms of weight vs ID (rim internal diameter) vs aero at hi yaw/stability vs price.

You mentioned the road market in addition to tri. Here’s a comment I made on Escape Collective in the past comparing road wheels that shows where Zipp possibly ranks among lightweight all around performance road wheels.

If I were to rank performance road wheels, here is a formula l’d propose:

MSRP/(1400g - Weight) + 5*(30mm - Internal Diameter) + 50mm - Rim Depth

This gives preference to wider internal diameter rims, wheel weights further below 1400g, and rim depths closer to 50mm. I should probably penalize non-aero spokes, but not today.

Lower Score is Better:

Zipp is doing OK

That is one way, but there are probably multiple ways of computing a “performance score”. And thay way of calculating will be different between Gravel, Road, tri, TT…

Interesting (and a bit scary TBH ![]() ) to add up factored dimensions like USD, length and weight. Where did you get factors from?

) to add up factored dimensions like USD, length and weight. Where did you get factors from?

Where I am (Spain) HED wheels are cheaper than DT Swiss as an example.

HED is winning a heck a lot a races for having such a bad score according to you math, right?

Remember the best performing wheels, and the ones winning the market is not always the same. The difference is marketing ![]()

I have been on Zipp wheels for like 20 years and just changed over to DT Swiss

This is a ridiculously arbitrary and nonsensical equation. The fact that it doesn’t account for aero performance and external width (I assume that’s what you meant instead of diameter) doesn’t help. Hookless vs hooks deserves a penalty for road/tri, as well.

External width matters more from an aero perspective than internal, and your equation benefits a wheel like Zipp where the external width isn’t enough for its internal width and a byproduct of being hookless. Meanwhile wheels like Roval Rapide which are super wide relative to the internal width (and test very fast) are penalized by your nonsense.

I recently went to Silverstone after a ton of road testing

3 wheels of different rim depth, 2 different inner width, 2 different tires, 4 different tire widths and we did all kind of permutations combinations and came out with all kinds of results

then we made a matrix of road conditions, speed, yaw, accelerations, weight, stiffness… type of race situation. We came out with 6 “situations” to choose the best performing wheel. It was fun ![]()

I have to take exception with your statement that Shimano has done anything in the wheel market. The different tests out there (e.g., Cyclingnews) consistently find the Shimano wheel at the back of the pack for aero and stability. While cup and cone bearings can be nice if you are totally on top of your maintenance, it is a technology that is about as popular and appealing as tubular tires. The wheel weights are mediocre and even the appeal of the graphics is Meh. I would say that Shimano shows no more interest in making a good wheel than they show for making a power meter that works or fixing the safety/durability issues of their cranksets.

Shimano is like Toyota. They make some solid products, but they refuse to admit that they are falling behind. I think SRAM will continue to eat into their share of the group set market and their share of the wheel market will continue to decline.

the trends you got from this would be interesting