Originally published at: Insights From the Combined 2025 IM World Championship Bike Counts - Slowtwitch News

We came. We saw. We counted.

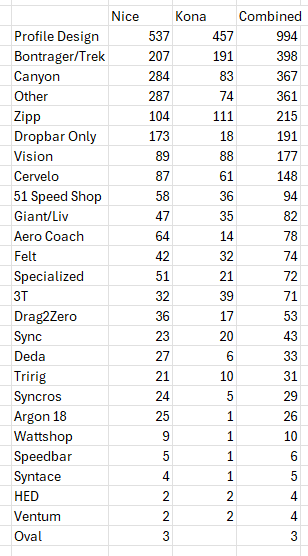

There were nearly 4,000 bikes and their various components that we counted across the 2025 IRONMAN World Championship races in Nice and Kona. As we covered before, Canyon and Cervelo took top honors for the respective men’s and women’s races. Profile Design, as expected, was well represented in aerobars, along with Shimano in drivetrain choice. And in a surprise, DT Swiss swept both the men’s and women’s wheel count.

We wanted to take a deeper dive into some of the categories we counted this year, as well as present a unified look at the counts across the two races. Here’s what we found.

Bikes: There’s a Wide Gulf Between the Top 3 and Everyone Else

The top three brands should not come as a surprise to anyone within endurance sports over the last, oh, 20 years. Let’s start with second placed Cervelo; they have arguably had the most consistent investment in triathlon over that period of time, and it was only recently that they’ve lost the top spot in the overall standings to Canyon. It was perhaps notable that Cervelo led the women’s count in Kona this year, whereas Canyon built its overall margin in the Nice count.

Speaking of Canyon, they have exploded in popularity over the past seven years. Looking back at the 2018 Kona Bike Count results, they had a mere 130 bikes in total in the field — lagging well behind Cervelo, Trek, Specialized, and Felt. Between increased availability in the United States, a healthy sponsorship program for professionals, as well as the COVID-era cycling purchasing boom, the brand put in the kind of legwork that Cervelo had done in the early 2000s that led to its longtime dominance in the counts. (It’s notable, then, that most female professional triathletes who were riding Cervelo bikes opted to tape over the Cervelo logos in Kona this year.)

Trek, too, remains quite popular, with roughly one out of every six athletes riding one of their machines. That will be something we’ll need to watch over the coming years, as currently the least expensive complete Speed Concept you can purchase will run you $9,500 USD. That bike comes with electronic shifting Shimano Ultegra Di2 and Bontrager 51mm deep wheels, but it’s still a nearly $10,000 bike as the entry level complete triathlon bike. You still can purchase a rim brake Speed Concept frame for $3,630.

There’s then a 350 bike gap down to fourth place and Quintana Roo. If I were a betting man, I would suggest that QR is most likely to make a leap up the bike counts. It already has done so over the 2023 and 2024 counts as it opens up the European market more. Comparable builds to the above least expensive Speed Concept will run you, as of this writing, about $3000 less (note: QR is running a promotion for free wheel upgrades to HED’s Vanquish V62; typically, a comparable QR is still $2,000 off a Speed Concept price).

The other big mover upwards are the combined Giant brands. There were 207 riders aboard either a Giant, LIV, or CADEX branded bike at this year’s races, which as a single brand would have placed it sixth overall. I would suspect that they will comfortably move ahead of Specialized as a combined force next year for fifth place. It probably would not come as a surprise to find Giant alone as a brand ahead of the likes of Felt, BMC, and Scott.

There are a couple of brands who might have over-indexed over the last few split IRONMAN World Championships. Cube, in particular, will be one to watch; they have had very strong runs in Nice but with the move back to Kona may not crack 100 bikes next year. LIV, too, has benefitted from the single-gender races.

One last thing we’ll be interested to watch for are the numbers for brands that have taken their off of triathlon entirely. For example, Cannondale has not produced a triathlon-specific bike since COVID, yet still has seen a not-insignificant number of their bikes at the World Championship.

The total counts are as follows:

| Bike Brand | Nice Count | Kona Count | Totals |

|---|---|---|---|

| Canyon | 502 | 270 | 772 |

| Cervelo | 380 | 328 | 708 |

| Trek | 347 | 256 | 603 |

| Quintana Roo | 112 | 132 | 244 |

| Specialized | 141 | 86 | 227 |

| Argon 18 | 81 | 71 | 152 |

| Felt | 70 | 69 | 139 |

| BMC | 81 | 36 | 117 |

| Scott | 83 | 31 | 114 |

| Giant | 95 | 13 | 108 |

| Cube | 77 | 28 | 105 |

| LIV | 1 | 74 | 75 |

| Orbea | 37 | 30 | 67 |

| Pinarello | 28 | 17 | 45 |

| Ceepo | 24 | 19 | 43 |

| Cannondale | 20 | 19 | 39 |

| Factor | 26 | 10 | 36 |

| Ventum | 12 | 13 | 25 |

| CADEX | 19 | 5 | 24 |

| KU | 14 | 8 | 22 |

| Dimond | 14 | 4 | 18 |

| Look | 8 | 8 | |

| Ridley | 7 | 1 | 8 |

| Willier | 6 | 1 | 7 |

| Airsteem | 4 | 3 | 7 |

| Colnago | 5 | 5 | |

| Focus | 3 | 1 | 4 |

| Parlee | 1 | 3 | 4 |

| Guru | 1 | 1 | 2 |

Drivetrains: Shimano and SRAM Only Apply

Perhaps more surprising than Shimano’s sheer dominance as a single manufacturer is just how few bikes are coming equipped with Campagnolo (or Microshift, for that matter). As far as we could find, there’s just a sole bike brand currently offering an OEM-purchase with Campagnolo components on board, and that’s Look. Otherwise, nearly everything is Shimano and SRAM fully. The days of piecemeal spec (e.g., my first triathlon bike, a Felt, featured an FSA crank, Shimano derailleurs, and Microshift shutters) to hit a particular price point are long gone.

| Brand | Nice Count | Kona Count | Totals |

|---|---|---|---|

| Shimano | 1,661 | 1122 | 2,783 |

| SRAM | 717 | 400 | 1117 |

| Campagnolo | 10 | 3 | 13 |

| Other | 3 | 2 | 5 |

Pedals: Power Drives Speedplay Downward

Shimano and Look have long held the top two positions in the bike count, and they have held roughly the same amount of marketshare for the past decade. But Favero and their Assioma pedal line up, along with Garmin and its various pedals, now make up over 1,250 riders. Power in the pedal has been a game-changer.

The company who has been hit hardest by that change is Speedplay. The relatively long gestation period after Wahoo purchased Speedplay in 2019 for new product, in no small part due to the COVID boom in indoor training, has meant that Speedplay’s lost about 30% of its overall IM World Championship marketshare since 2018. That said, it’s not like Wahoo is ignoring the power pedal market, either. The Speedplay power pedals are good product. It’s just a question of whether Wahoo can convince riders again of the benefits of the Speedplay system versus the more-traditional SPD / Keo style pedals on offer from Favero and Garmin.

| Brand | Nice Count | Kona Count | Total |

|---|---|---|---|

| Shimano | 596 | 466 | 1,062 |

| Look | 492 | 310 | 802 |

| Assioma | 421 | 271 | 692 |

| Garmin | 316 | 264 | 580 |

| Speedplay | 187 | 116 | 303 |

| Time | 139 | 17 | 156 |

| Powertap | 6 | 13 | 19 |

Saddles: ISM Remains the Standard, But Selle Italia is Moving Up

ISM has been at the top of the saddle count for over a decade. The brand that popularized the split nose saddle trend continues to lead, but that margin is shrinking. ISM at one point doubled the count on the next closest competitor, which had been Fizik. Selle Italia, meanwhile, has stormed up the ranks, in thanks to its Watt series of saddles. They’ve quadrupled their saddle count over the past decade. It’s also notable that Selle Italia comes as a stock option on many of the top bike brands, including on select Canyon, Cervelo, and Quintana Roo models.

Trending downward are the likes of Cobb (aka jCob), Gebiomized, and Shimano / PRO saddles. I don’t think that has much to do with the quality of product they have, per se. I think it more has to do with the improved quality of stock options on bikes that is reducing the need for an aftermarket saddle purchase. (Editor’s Note: Yes, I understand the irony of that statement from someone who broke his pelvis last summer because he ignored saddle pain. That’s a Ryan is a moron problem.)

| Brand | Nice Count | Kona Count | Totals |

|---|---|---|---|

| ISM | 401 | 386 | 787 |

| Selle Italia | 322 | 195 | 517 |

| Fizik | 238 | 128 | 366 |

| Bontrager | 155 | 142 | 297 |

| Specialized | 105 | 182 | 287 |

| Prologo | 143 | 97 | 240 |

| Cobb | 41 | 55 | 96 |

| Gebiomized | 19 | 21 | 40 |

| SMP | 22 | 14 | 36 |

| Shimano | 20 | 14 | 34 |

| Wove | 28 | 5 | 33 |

| Terry | 6 | 3 | 9 |

| Dash | 6 | 6 |

Wheels: The Rise of OEM-Spec Wheels

This is a bit of a similar story to the one we find with saddles; brands that more frequently come as stock options are making their way to the World Championship events. As mentioned by one of our counters in our reader forum, roughly three quarters of the bikes that were ridden in Kona this year appeared to have been rolled off the showroom floor, with just the addition of front and rear hydration being the sole modification from stock.

Still, that’s to take nothing away from the remarkable rise of DT Swiss. Prior to the COVID pandemic, DT Swiss had 124 total wheels in the race. Not wheel sets. Just individual wheels. They lagged far behind the likes of Zipp, ENVE, HED, Reynolds, Bontrager, and Mavic. They were roughly where Roval is in modern times. That’s a huge switch in fortune.

Again, it helps that you can easily procure DT Swiss as part of a complete build from bike manufacturers today, including Canyon and QR. Meanwhile, Zipp is harder to come by in an OEM-purchase; you’re more likely to have to add them on after the fact. That’s simply introducing far more friction into the purchasing journey at this point. It’s becoming apparent that people are making a single, one-and-done, purchase of their equipment. Roughly half of the Trek’s in the field came adorned with Bontrager race wheels. Quintana Roo’s almost all had DT Swiss, HED, or Reynolds wheels; all of those have been OEM options in recent times.

Those who are deciding to purchase secondary wheel sets also have more options than ever. We had nearly as many riders not on a CADEX bike on CADEX branded wheels. Swiss Side has steadily increased marketshare. It’s an embarrassment of riches when it comes to product. Zipp will need to do something to help make it easier for consumers to get their hands on product, and to give the brand the thought leadership position that it held onto for years.

| Brand | Nice Count | Kona Count | Totals |

|---|---|---|---|

| DT Swiss | 505 | 273 | 778 |

| Zipp | 410 | 206 | 616 |

| Bontrager | 189 | 141 | 330 |

| HED | 111 | 78 | 189 |

| Enve | 90 | 87 | 177 |

| Roval | 105 | 53 | 158 |

| Swiss Side | 71 | 28 | 99 |

| Reynolds | 55 | 39 | 94 |

| Vision | 45 | 29 | 74 |

| Giant | 51 | 18 | 69 |

| Cadex | 20 | 22 | 42 |

| Hunt | 22 | 13 | 35 |

| Shimano | 24 | 9 | 33 |

| Syncros | 30 | 30 | |

| FFWD | 16 | 7 | 23 |

| Fulcrum | 20 | 20 | |

| Flo | 15 | 4 | 19 |

| Profile Design | 6 | 4 | 10 |

| Corima | 2 | 5 | 7 |