Powell tonight on 60 Minutes

Powell: ‘The US is on an unsustainable fiscal path’ | The Hill

I agree.

Powell tonight on 60 Minutes

Powell: ‘The US is on an unsustainable fiscal path’ | The Hill

I agree.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

Most likely outcomes.

Government will attempt to mitigate/reduce the debt through inflation. Regardless of what the Fed says, and political reasons to lower rates to make the economy look better, inflation is going to stay at current levels or even slightly higher for a very long period of time imo. I would say basically forever until the dept to GDP ratio could be reduced by 50% from where it is now.

The other (and less painful, at least for 90% of Americans) fix would be to restore the tax code to basically pre-Reagan era. Eliminate all the Reagan, Bush, Trump era tax cuts for corporations and the ultra-wealthy. This is the fastest way to make a dent in the debt. Unlikely, because corporations and the ultra wealthy control both parties.

Other obvious consequence is SS eligibility requirements get tighter (increase minimum age for benefits, for full retirement). Or SS taxes go up, or again, simplest move (but hurts ultra-wealthy) is to remove the cap and tax all earning for SS, not just the first $160K. Right now social security is already paying out more in a given year than it is taking in (and this gap will widen indefinitely), so one thing that is certain is that SS taxes will go up and/or benefits will be reduced, there is no more growth pyramid-scheme to hind behind.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

“Integrity is priceless. And at the end, that’s all you have.â€

Also said. re interest rates and poliitcs, but also for life writ large

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

The difference is that there are “Simple” things we can do to fix the financial issue. Climate change not so much. But both can have huge, devastating consequences to some people.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

The difference is that there are “Simple” things we can do to fix the financial issue. Climate change not so much. But both can have huge, devastating consequences to some people.

Working stiffs who didn’t have enough in 401K’s reductions, later collections (laboring at age 68?) this is huge, devastating.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

Exactly, the boy who cried wolf phenomenon.

A third one would be we’re going to run out of oil soon. At least in that case there must be a finite amount in existence that we are burning through at a prodigious rate.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

Not really. We have been experiencing the effects of climate change for a while. Federal debt? Not so much.

Republicans have been whining about the debt (except when they are in power: go figure) for decades. They want to destroy government and put all the power in the hands of corporations. Nobody is lying about climate change to make a profit.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

Most likely outcomes.

Government will attempt to mitigate/reduce the debt through inflation. Regardless of what the Fed says, and political reasons to lower rates to make the economy look better, inflation is going to stay at current levels or even slightly higher for a very long period of time imo. I would say basically forever until the dept to GDP ratio could be reduced by 50% from where it is now.

The other (and less painful, at least for 90% of Americans) fix would be to restore the tax code to basically pre-Reagan era. Eliminate all the Reagan, Bush, Trump era tax cuts for corporations and the ultra-wealthy. This is the fastest way to make a dent in the debt. Unlikely, because corporations and the ultra wealthy control both parties.

Other obvious consequence is SS eligibility requirements get tighter (increase minimum age for benefits, for full retirement). Or SS taxes go up, or again, simplest move (but hurts ultra-wealthy) is to remove the cap and tax all earning for SS, not just the first $160K. Right now social security is already paying out more in a given year than it is taking in (and this gap will widen indefinitely), so one thing that is certain is that SS taxes will go up and/or benefits will be reduced, there is no more growth pyramid-scheme to hind behind.

I’m similarly baffled about why (aside from the political barriers) we don’t use the tax code to pull capital out of the economy as one of the tools to address inflation rather than relying on higher interest rates to do that same job. Must be better to have that money going to the IRS than the bank and savers; and would encourage long term capital investment from businesses.

I think it is a matter of flexibility and timing. The Fed can change interest rates as fast and as much as they like. There is no similar knob for taxes which are usually calculated on an annual basis. You could probably get away with it with sales tax, but in the US that is done at state and local levels. It would have a more immediate effect than interest rates however.

Edit: Thinking more on this, places like the UK could probably do it with their VAT, but I don’t think the voting public would appreciate it. “Inflation is making everything more expensive, so we are going to increase the VAT” isn’t something they would want to hear. Central bankers increase interest rates is much more palatable to the public.

I thought I also heard him say our global role assumed after WWII and continuing forward has had and contiues to have a marked positive influence on our economy in ways not defined and that he hopes to have it continue. MAGA nationalists in search of a more isolationist role to our global outreach cringed when they heard that. Or it fell on deaf ears.

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

People have been warning about the debt for years but the last 15 years has seen a massive spike, from 10 Trillion in 2008 to 31 Trillion today. The cost of borrowing has also spiked in recent years, which makes the cost of servicing the debt much higher and a larger part of the budget. This year the cost to service the debt will be 18% of the total Federal budget. For comparison it was 5-8% for most of the early 2000’s.

Addressing the issue is very challenging. Some of it can be addressed by growth and lower borrowing costs but long term it requires both an increase in revenue and a reduction in spending. This would almost certainly result in a recession like we had in the early 80’s.

What does this mean? It means that borrowing costs will remain high for the foreseeable future. The Fed only controls the Federal Funds rate, they do not control the 10-year treasury. Lowering the FFR will bring down the 10 year yield a bit but as long as the US carries so much debt borrowing costs will remain high.

Powell tonight on 60 Minutes

Powell: ‘The US is on an unsustainable fiscal path’ | The Hill

I agree.

You cherry picked one take away from that interview. Taken in context with the entire interview and the take away is “the sky is NOT falling” as so many hack want you to believe.

“The U.S. federal government’s on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. So, it is unsustainable. I don’t think that’s at all controversial,†Powell said when asked if the national debt is a danger to the economy.

No, it absolutely is controversial because there’s a large portion of the electorate and the elected that think we can just keep printing money. Gaslighting in the highest regard.

When money out is greater than money in, you have debt. Our politicians have convinced us it’s so much more complicated than that.

Keeping it simple…imagine this was your personal credit card and you had lots of debt. There’s two things to think about: 1) How to pay down the debt and, 2) How to slow your spending so you don’t further increase your debt.

We’re generally doing neither.

Powell tonight on 60 Minutes

Powell: ‘The US is on an unsustainable fiscal path’ | The Hill

I agree.

You cherry picked one take away from that interview. Taken in context with the entire interview and the take away is “the sky is NOT falling” as so many hack want you to believe.

Here is the full interview.

https://youtu.be/ImrKxlLJCEY?si=WjENs4kOcIy7aThd

Powell’s positive comments about the economy have been in line with what I have repeatedly posted here so I saw no need to repeat what I have already posted. The economy is doing far better than most expected. Powell was right, while most the naysayers were wrong.

I do not think the sky is falling but I share Powell’s concerns about the debt. It does need to be addressed. As he said

“It is time for us to put a priority on fiscal sustainability and sooner is better than later”

Serious comment from me. What does this look like 5-10-15 years from now. More?

Paint a picture for a guy who’s wheelhouse doesn’t really include finance and economics.

Intuitively his comment isn’t surprising and our govt spending has far outpaced the revenue. But I’d never been able to get passed that.

I have next to no understanding of economics. I do know people have been saying this for as long as I can remember, and we still haven’t fallen off the cliff.

That is also the argument people use to dismiss climate change.

The difference is that there are “Simple” things we can do to fix the financial issue. Climate change not so much. But both can have huge, devastating consequences to some people.

Working stiffs who didn’t have enough in 401K’s reductions, later collections (laboring at age 68?) this is huge, devastating.

I was thinking about the poor people who’s lifeline may be cut if we actually adjusted our spending.

I was thinking about the poor people who’s lifeline may be cut if we actually adjusted our spending.

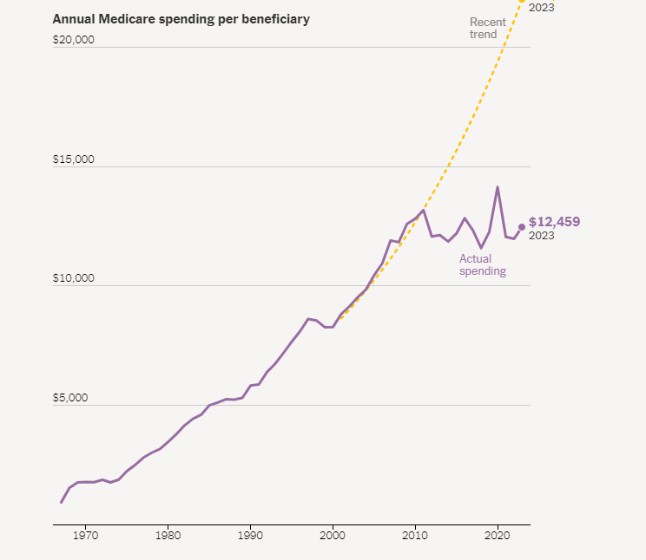

The good news is that Medicare spending has apparently flattened per beneficiary. (graph per NYT)

I agree that if either Medicare or SS ages are increased or benefits reduced, that will affect poor people the most.

I tend to think the first place to start is to roll back tax cuts of the past decade or so. Take a hard look at some defense spending. But anyone who suggests either of those things instantly has 1000 darts headed their way. You turn yourself into political chum bait.

“The U.S. federal government’s on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. So, it is unsustainable. I don’t think that’s at all controversial,†Powell said when asked if the national debt is a danger to the economy.

No, it absolutely is controversial because there’s a large portion of the electorate and the elected that think we can just keep printing money. Gaslighting in the highest regard.

When money out is greater than money in, you have debt. Our politicians have convinced us it’s so much more complicated than that.

Keeping it simple…imagine this was your personal credit card and you had lots of debt. There’s two things to think about: 1) How to pay down the debt and, 2) How to slow your spending so you don’t further increase your debt.

We’re generally doing neither.

Except it’s not a credit card.

There is a third option to raise taxes. Probably the best way to control inflation and reduce the growth of the debt.