Results here:

Results here:

http://lavamagazine.com/2017-ironman-bike-count/

Cervelo the leader by a mile.

Ventum and Dimond well represented tho.

Dimond as lost 1/3 of there bike from 2016 to 2017 so definitely a significant drop.

Canyon is the big mover with a 300% growth and now at 100+ bikes. And this number will only go up if canyon can figure out a proper distribution to canada and usa.

Canyon reminds me of the Cervelo of 15 years ago. New kid on the block getting a few bikes in the count, then marching up each year while knocking off huge bike companies along the way. Cervelo had to take down Trek, the behemoth in the bike industry and they have not looked back since taking that top spot.

Only question is does Cervelo continue to innovate and hold all those athletes, seems so to me. Trek was an easy take down along with Cannondale and a few of the others, just too big with too many levels to me nimble enough to make those quick changes and adaptations. Cervelo is now a very big company too, but did they retain that nimbleness? Time will tell, but I predict in two years that Canyon takes over 2nd place from Trek…

I don’t understand why Canyon is so popular. I am sure they are nice bikes and the price is Ok, but not stellar. Decent aero, but still behind Cervelo and Trek and probably whatever the new Shiv will be). A lot of money to spend on a bike you can’t even test ride and have no direct access to spare parts.

I am also a bit surprised that Felt doesn’t do a bit better.

The wheel count is interesting with Zipp have about 5-6 times as many wheels as ENVE in 2nd place. That is pretty much the definition of dominant.

Agreed. I don’t find the Canyon bikes attractive. I also don’t understand why Felt hasn’t grown to 3rd place. They are consistently 4th. The new draft box and calpac should make the IA sell more

Javelin 1, Griffen 1 oh my

.

Two of Dan’s Premier bikes.

First time that Cervelo number has fallen, maybe 25% is saturation level for a bike brand.

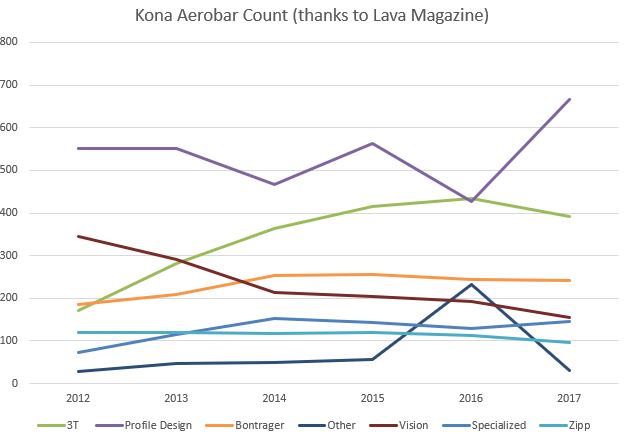

Aerobar count shows that last year was a bit of an error where a lot of Profile bars got counted as ‘other’

Zipp (wheels), ISM (saddles) and Shimano (groupsets) totally dominating their categories as usual

I’ve been wondering how Shimano has such high numbers compared to SRAM. Are they offering bike companies large discounts to spec their group sets?

If you’re speccing a bike that you want to be easy to sell you put Shimano on it. Can get away with SRAM on CX and Gravel, but apart from Etap it’s a risky proposition to spec SRAM. And obviously Etap is only for your highest price model.

It’s been a while since I’ve done any bike spec, but last I was - SRAM had much shorter lead times and good pricing. It’s just that the market for road going bikes wants Shimano. Shimano doesn’t need to give any favours.

And Ultegra Di2 is the cheapest electronic groupset, would be interesting to have a further breakdown of the Shimano numbers to see how big that set is.

Shimano is pretty well entrenched. Also remeber that ETap stuff wasn’t readily available 12 months ago. They seemed to be supply constrained until about Feb/March

One of those Tacticsls was in 1st place for 90 of the 112 miles. 55-59. Ended 4th

He had me ship the bike to Kona- built and fitted him yesterday - great result.

Javelin 1, Griffen 1 oh my

I have a Javelin bike (no kidding) best ever ![]()

But Argon is up there, no fan-fare just good bikes I guess?

Last year was a bit of an anomaly as there wasn’t any product experts there to count bars. But this year, myself and Thorsten from PD were the counters and you can see that the numbers do seem to match historical numbers much better.

FWIW, we try to identify the clip/cup assembly to count. If we can’t identify it (which is rare), we go to the basebar and then to the extensions. Ideally, we would have more counter to count extension only as those seem to be what most athletes will change in the AM.

Those Cannondale numbers. Ouch.

Power meter usage trends since 2009:

http://alex-cycle.blogspot.com.au/2017/10/kona-power-meter-usage-trends-2009-to.html

.

The annual Kona bike count is always something interesting to look at and talk about.

It is and is not something definitive on what is going on in the market. You can link up some cause and effect in one place, and then that means nothing else where.

What it is is really a snap-shot in time of the bikes being used in Kona. The key thing is to look at the trends and who is moving, in what direction and what is the influence.

Canyon clearly has been the big mover from last year to this year. Why is that? It could be a combination of things - the sales model they are using, the quality/performance of the product, the success of their marquee athletes - Jan Frodeno, and less so Patrick Lange. Whatever the case, they are on the move, and my guess is that Canyon number will grow next year, at other brands expense.

That Cervelo is the dominant brand is no surprise - what is surprising is that no one has come even close to them in years now, and the trend looks to continue for at least a few more years. For Cervelo, the success is really rooted in the original innovation and performance of the product and some momentum that has built up over 10 - 15 years.

It’s got to sting for Diamondback that three years and two bikes into their push, they only had 7 bikes in the race at Kona.

It’s got to sting for Diamondback that three years and two bikes into their push, they only had 7 bikes in the race at Kona.

They have overpriced bikes that aren’t visually appealing to the masses.

I am really shocked Felt IA didnt up the game for felt…or even Fuji…they got some well priced bike, maybe not super aero but well priced for the specs.