Retired at 56. Never regretted it for a second. The extra free time has let me double down on practicing yoga (pretty much daily), learning Spanish (am now near fluent), and try out new recipes. I still do the sbr thing, but am also really enjoying bike touring. Such a joy to be able to take off for a month+ with no worries. The wife and I also travel a bit and I occasionally volunteer at a local food pantry. Plus there are the grandkids to spoil!

Still time to find a second career. A friend of mine sold his company for multiple millions at age 48 and decided he would retire. He played golf everyday, worked out everyday and hung out with his wife. ( his kids were in college). After about 6 months he decided to start another company as he got tired of playing golf alone as all his friends still had jobs and he didn’t want to hang out with 70 year olds just yet.

We’re still in the “let’s look at our options” phase. He’s only 20 but he’ll be finishing his undergrad at the half way point of his junior year (2 1/2 years total) which is coming up quick.

Med school is one option.

We will likely have to get some loans but the idea of him starting his “adult life” with a mountain of debt is going to be avoided as much as possible.

I’m kind of looking at this way. My usefulness to the world has nearly run its course and investing in myself at this point is purely selfish. I’m looking to the future world, one that I will eventually be a burden on (or just not in at all anymore). My son is part of that future, so whatever I can do to help him contribute more to the future as a whole, I will do.

I like to play a hybrid craps strategy. $300 Don’t Pass bet and then $280 to $330 on the inside numbers, depending on the point. It allows you to take advantage of long rolls and protect yourself on the short rolls.

My mom is paying for both of my sons’ college education. It looks like my older son will be in college for about 8 years for a PhD and my younger one about 6 years for a master’s degree.

That sounds reasonable and makes sense. I just couldn’t swing the payments on the loan and still try to live if I stopped working. If he does go to med school, he would be able to pay off that mountain of debt pretty quick assuming he get thru residency and starts practicing by age 28 or so. If he made 400K-600k a year as a doc, the debt could be paid off pretty quick.

I do understand wanting to set him up however. One of the best things any parent could do for a kid in my book.

I bet you get the stink eye betting on the don’t pass. I rarely make money and typically break even. I play roulette and bet first set of number and last set of numbers at same time and it makes me more money than craps.

Betting on Don’t Pass is the same as betting on black or red when playing roulette. It is becoming more and more common to see people betting Don’t Pass and no one has ever given me shit about it.

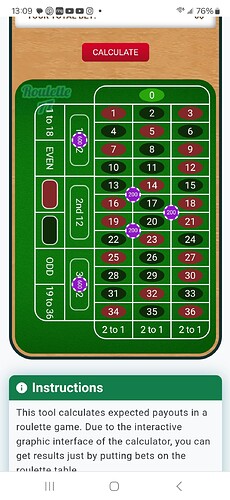

This is one of my roulette betting strategies:

It earns me 5,000 tier credits in about 70 minutes.

I’d rather he go into debt buying a building where he’d have his practice.

I use the 1st 12 and last 12 like you have shown here but don’t put the triangle on the numbers. May have to start doing that and see how it goes.

my wife will retire in a couple years at 60. SS and teachers pension

we can travel more once she retires as she has a lot of time off but it’s all concentrated in summer/breaks. Want more flexibility.

I will stay full time at least 3-5 more years while youngest finishes college and my 20 somethings get (hopefully) closer to pulling their heads out of their collective asses.

If I can step down to CFO position and elevate someone else to President, particularly if I can work part week and/or remotely for several months I can go as long as I can go.

I plan to evaluate SS yearly. The longer I push off the larger my wifes survivor amount will be

Our nut without kids is small enough to last until 70 with wifes SS and pension payment without me in SS or any of our (pretty substantial) pre tax savings vehicles.

Somebody besides me and wife are going to “get it all” at some point. Either diaper service/retirnent home or the kids.

My job was to save it until I could outlive it for anything I can reasonably account for. I have done that. The rest is just easy decisions from there.

Good luck.

You bring up another good question. Should one spend all of their money and die penniless after having had a great time, or leave a lot for your kids to spend on fast women and booze? I have told my father, who is still going strong at 84 to spend it all on himself and don’t leave me or my siblings a cent. Hard to know when you will go for sure, but don’t want him worrying about money so he can leave it to us.

I don’t plan to leave a lot to my kids as there won’t be much to leave. If I don’t have to bother them, or move in when them when I get really bad, ( if I get there) then that will be good enough. Nursing homes burn through money like a coke addict in Miami.

My roulette betting system is designed to earn tier credits.

If 17 or 20 rolls, you win $1,800.

If 0, 00, 15, or 24 rolls, you lose $1,800.

Any other number is a push.

You can swap the style around to change jackpot numbers and losers.

My mom is 94.5. She just outlived my parents money in the last. 12 months

I have a lot of money. That’s a relative term relative to me

I probably sacrificed something in the process not sure what.

My money is/was a score to keep and is fuvk you money.

You. My workers. My neighbors my kids my government pretty much nobody can make me do something I don’t want to do (and can’t pay my way out of)

If you don’t owe anybody anything you are rich. If you have money in addition to that you have options. Having options are better than not having options

My 20 year old may pull his head out of his ass and get involved in something in life I highly support. If he does I will support it

If he remains a lovable horses ass I will donate all my money to an (insert cause) in my moms name after I pass if I have any left

I’m way more focused on staying healthy and enjoying life and makibg it to 94.5. My father passed at 84.

I hear you, lots of folks I know went full on non-stop until they were 65, only to start getting a lot of health issues a few years after.

I am 44 and maybe, I will 80% retire in 2-3 years time depending on whether, let’s just say, something goes well. Not planning on doing nothing until I die, would like to do something meaningful, work 10-12 per week, teach college, help at the local animal shelter (although my wife worries I will come back with 20 dogs) always wanted to drive an 18 wheeler, but I am not sure I can commit to the intense schedules they have.

I owe, I owe so its off to work I go. I can’t imagine not having debts and probably never will. Car pmts will always be there, rent will be there, can’t afford to buy a house and costs of living aren’t going down.

If I was your lovable son, I would be pissed if my dad gave my inheritance to charity no matter how much of a jack ass I was. I would prefer he spent it on himself on trips and fun stuff so I could at least know he enjoyed it, But sounds like you already do that and have lots left over.

I’m 60 now and started winding down my consultancy business about a year ago. Currently i work about 10 hours a week average through the year, and at the rates people are prepared to pay me that is more than enough to live on and help out my 20 something year old kids. Thinking of stopping completely at the end of the year, but the 2 things that count against that are the mental shift to watching my savings start to go down as i live off them (even though i have enough to last for any reasonable lifespan), and the thought that 1 more year of work at 10 hours a week could pay a house deposit or similar for one of my kids.

Will probably take social security at 62 if not working, or whenever that first year of not working is after that.

I already take 1 US work pension which is about $1100 a month, and can take a UK work pension any time i want now i am past 55…

I think the only answer I can give is “when I think it’s safe to do so, and then maybe 1 year after that.” I will turn 57 this year but I have 2 kids that are in high school. Our current spend rate is too high, but should go down once the boys are launched, mortgage is done, house is fully up to date, cars are refreshed, etc. If the market had stayed on the same trend as the previous 3 years I would be pretty sure we could call it good after about 4 years, but if the market gets ugly the next few years and it takes another 3 or 4 to recover then I don’t know. I make pretty decent money and the job is pretty low stress, so I’ll keep at it until I’m confident in our security - wife is already pressuring me to hang it up ASAP so we can travel…but to travel we need money, which means I have to work!

My parents paid for my 4.5 years of college. That set me up in a good place.

My horses ass is 2 years into a 5 year degree in accounting (same degree I got). He will be in the same position when he’s done. And will lifeguard a couple summers while training for cross and track teams and enjoying the life I have made him accustomed to

Frankly I couldn’t care less what he thinks about the money I don’t/haven’t spent on him.

I hope he sees how I’ve done it (one house in 27 years paid off in 6 years etc etc) Decides he wants to be dependent only upon himself and uses what we’ve started him off as to accomplish that.

I’ll know he’s on the right track when he says fuvk you to something I want him to do for me. Because he can afford to.

That said if he’s his own man and wants to start something for himself I’m happy to be Mr Private Equity and charge him a fat vig to try.

My oldest graduated 18 months ago with no debt. He’s an RN. They do well. He can rent. Own a decent car with car payment. Buy as much fishing tackle he can stand and a kayak to use it in. And saves like 45-50% of take home. He’s his own man at 25. If he wants to change my diaper and wipe my chin when the time comes I’ll pay him for the dignity he gives me

I am with you on the spend rate too high. I may actually working until 70 and just suck it up. I have a hard time getting by on well over 250K a year and see no way I could ever make it on less than that, even in retirement. Rent, cars, food, insurance, the basics cost that just to live. I have been told I need 10 times my income saved to retire on and no way that is feasible even by 70. Saving 3 to 4 million is out of the question.

It won’t be safe for a long time for me to pull the plug. I may start to take SS at 62 just to have the extra buffer but not sure on that as well.

I know very few people and can’t comprehend the EFF you money situation. For a kid in his 20s to ever get to that level without help from his parents seems impossible.

The private equity option for your kids is a great plan. If they have an entrepreneur spirit that is the best way to ever provide for them. Seed money may potentially let them get to where you are.