I bought my first race bike in 1983. And I still have it, and still ride it occasionally.

Did we go to the same school and use our student loan money the same way?

I started in 85. I went to Uni in Quebec. Tuition for the year was 650 dollars. Total cost for me including room and board was 5000 a year. I could make that in a summer. I did live very cheap probably a dozen beers a year.

I’m pretty sure we both spent too much time at Rusty’s Last Chance.

I spent A LOT more time at Kite’s.

I paid less than 15,000/year total for each of my kids college.

If they could have gotten into Columbia or Dartmouth - I would have happily paid $35,000 year.

(That’s all those colleges would have asked me to pay. And I have a relatively high income and networth)

UC Davis (out-of-state) and some second tier private schools- would have charged me (or my kids) almost $80,000/year.

No f#cking way that would have made financial sense.

But neither of my kids had any financial sense at 18.

They are just beginning to get that now - that they are working and on their own.

Ha I was more of an Auntie Mae’s type. I was also an RCPD officer for 4 years and worked as one of the Aggieville cops for a couple years. This is from Rusty’s Last Chance, just a typical night walking the mean streets of the 'ville. I’m on the far right.

I’m on the far right.

Who’s the hottie on your lap?

Just somebody that I used to know. If I remember right, she won the bikini contest. This was 02-03.

What would go down today if this same situation happened? Would there be disciplinary action?

Good question. I wouldn’t take the same picture today.

The eyecandy didn’t age well?

Touché

And this is one of the reasons that the GOP runs all three branches of government.

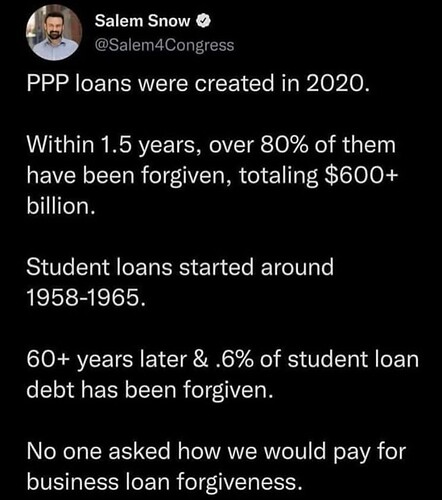

Sorry, but that’s a dumb tweet. Apart from the fact they’re called loans the two programs are not comparable. PPP loans were a stimulus check with conditions, they were designed to be forgiven.

I’m still don’t understand why people don’t mention the absurdity of the cost and the need to cut expenses.

Oh but they do. Dems have been howling about the extreme cost increases of college for as long as I remember - because they’re the ones sending their kids to college at a high frequency and thus are eating this cost.

While I’m all for funding higher education, I think the unfortunate lesson learned along the way, especially with Obama’s big push for college-for-all is that there are too many bad actor profiteers along the way that will happily exploit the system only to take the money if there aren’t enough regulating standards (yeah, I know the Repubs will sign off on that, NOT). Those online colleges that opened purely to basically steal all the college-aid money were just one example, but even the elite colleges started adding country-club type amenities to attract students knowing they could recoup expense with the huge gov’t largesse to students.

Alas, I don’t know a foolproof way to prevent this from happening. I do think one way the US could however fund more higher ed in the roles the countries needs immediately is to have partial loan forgiveness program for people who end up doing a needed job. One clear example is having specialist doctors moving to rural areas where they are badly needed. Perhaps something like 20% of loan reduction per year worked there out of med school would help these communities. But that’s not foolproof either as needs/jobs can change fluidly.

I don’t think the point is to compare the fine print of each. I think the overreaching message is that simply that the govt was able to give and then forgive hundreds of billions within 18 months. So why is there no reasonable discussion about doing it for the individuals who are saddles with this education debt that is in turn preventing them from injecting more of it into things that will bolster the economy.

My parents paid <$25k total for my entire 4.5yr. undergrad. 12x12 block wall dorm room. 1 roommate. (Put a sock on the door handle). Parents said…”Play football. Don’t get anyone pregnant. Get a degree!” At graduation there was some debt, but I don’t remember how much. The cool thing, was that every year, they applied for a loan, then invested it. (My dad retired in 1992 - never having made >$26k in his life). In 1985 the rate for loan was < than rate for new car. Took me about 3yrs. to pay back the loan. Drove the car for almost 10.

Ma was slightly more shrewd with $.