Many news headlines are shouting "Yield Curve inversion! Recession Imminent! Iceberg Dead Ahead!"

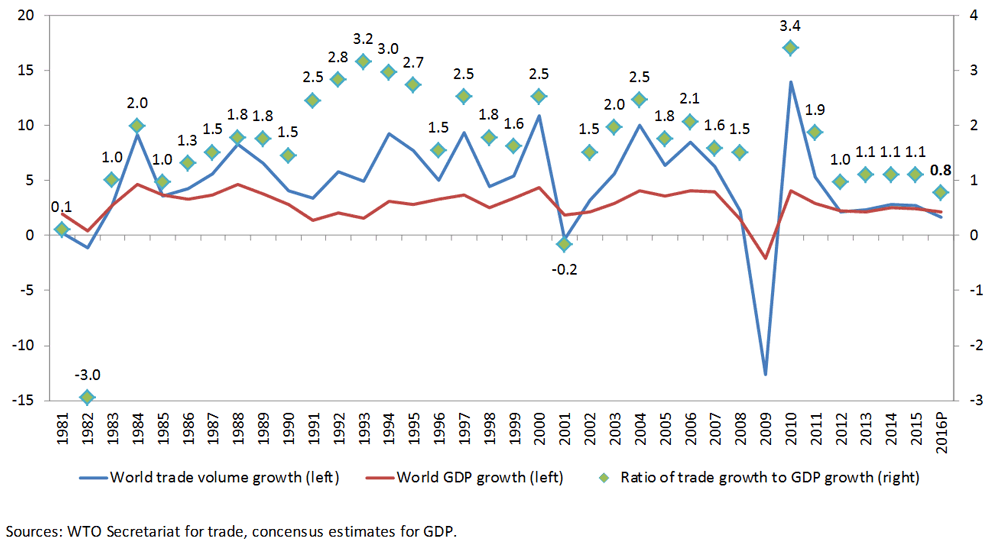

In some of my prior posts I've provided a sketch of the global geopolitical and economic order and the related financial architecture and explained the United States' outsize and central role in the global system. I've also hinted at how the end of globalization and the decline of global trade is disrupting.... everything. In the context of all of this I've wondered to myself "How on earth is it that the Fed can tighten when everyone else in the world is either on hold or actively easing? How is it that the disconnect in policy isn't affecting U.S. capital markets?"

Well, I'm not alone in that. Below is a short interview with Mohamed El-Erian.

Key words: "the bond markets are distorted"

Along similar lines, consider the below charts.

Ponder that last chart. Of all of the investment grade interest payments being made globally, the U.S. is responsible for 94%. That's completely unprecedented. That is an enormous... mind boggling distortion. In effect, if you need to invest in investment grade bonds (high quality for those who don't know) and you need to actually invest at a positive return (seems like a good idea to me!) your only choice at this point is to invest in the U.S. How on earth would such a setup not distort our capital markets?

The four most dangerous words in investing are:

This. Time. Is. Different.

However, this time I suspect we're looking at something very different indeed. Globally you have some really unprecedented demographic distortions: Europe, Japan, China, Taiwan, South Korea.... that's a huge chunk of the global economy

A former professor of mine recently noted that the decline in births in Europe between 1985 and 1995 only has a single historical parallel: the Black Death. There will be economic consequences.

Those population pyramids paint a very clear picture for the currencies and bond markets of those countries: their central banks will be forced to drive rates to zero or below for a generation and do whatever they can to devalue their currency in the process. Their respective governments will have to fall back on infrastructure investment to stabilize their economies even though they both lack the young workers and any significant need for infrastructure (as opposed to India which would reap significant economic benefits considering that fewer than 47% of their roads of paved and they only have ~1,000km of paved, multi-lane highways). Without access to foreign markets that can afford their goods (cough... the U.S... cough) the domestic manufacturing of the aforementioned countries will collapse as they cannot possibly consume their own domestic output.

Below is the U.S. which has a relatively healthy population pyramid. In fact, this is a population pyramid that can both consume its domestic production and produce excess capital.

In light of how overvalued U.S. equity markets are by traditional measures, I'm very reticent to say that things could carry on apace for a while longer. But they might. We're just now beginning to feel the effects of events that were set in motion over thirty years ago.

In some of my prior posts I've provided a sketch of the global geopolitical and economic order and the related financial architecture and explained the United States' outsize and central role in the global system. I've also hinted at how the end of globalization and the decline of global trade is disrupting.... everything. In the context of all of this I've wondered to myself "How on earth is it that the Fed can tighten when everyone else in the world is either on hold or actively easing? How is it that the disconnect in policy isn't affecting U.S. capital markets?"

Well, I'm not alone in that. Below is a short interview with Mohamed El-Erian.

Key words: "the bond markets are distorted"

Along similar lines, consider the below charts.

Ponder that last chart. Of all of the investment grade interest payments being made globally, the U.S. is responsible for 94%. That's completely unprecedented. That is an enormous... mind boggling distortion. In effect, if you need to invest in investment grade bonds (high quality for those who don't know) and you need to actually invest at a positive return (seems like a good idea to me!) your only choice at this point is to invest in the U.S. How on earth would such a setup not distort our capital markets?

The four most dangerous words in investing are:

This. Time. Is. Different.

However, this time I suspect we're looking at something very different indeed. Globally you have some really unprecedented demographic distortions: Europe, Japan, China, Taiwan, South Korea.... that's a huge chunk of the global economy

A former professor of mine recently noted that the decline in births in Europe between 1985 and 1995 only has a single historical parallel: the Black Death. There will be economic consequences.

Those population pyramids paint a very clear picture for the currencies and bond markets of those countries: their central banks will be forced to drive rates to zero or below for a generation and do whatever they can to devalue their currency in the process. Their respective governments will have to fall back on infrastructure investment to stabilize their economies even though they both lack the young workers and any significant need for infrastructure (as opposed to India which would reap significant economic benefits considering that fewer than 47% of their roads of paved and they only have ~1,000km of paved, multi-lane highways). Without access to foreign markets that can afford their goods (cough... the U.S... cough) the domestic manufacturing of the aforementioned countries will collapse as they cannot possibly consume their own domestic output.

Below is the U.S. which has a relatively healthy population pyramid. In fact, this is a population pyramid that can both consume its domestic production and produce excess capital.

In light of how overvalued U.S. equity markets are by traditional measures, I'm very reticent to say that things could carry on apace for a while longer. But they might. We're just now beginning to feel the effects of events that were set in motion over thirty years ago.

Last edited by:

GreenPlease: Aug 16, 19 19:29