Read this article and nearly wanted to puke a few times: https://www.theatlantic.com/...35/#article-comments

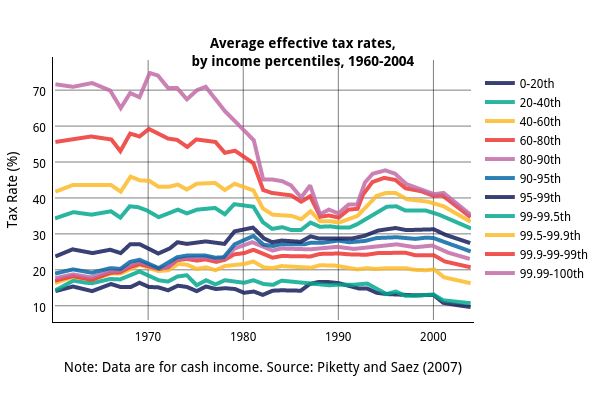

"It’s not just a failure of housing policy. It's a symbol of everything that’s wrong with the American tax code."

"Federal housing policy transfers lots of money to rich homeowners, a bit less to middle-class homeowners, and practically nothing to poor renters."

"Meanwhile, in 2015, the federal government spent $71 billion on the MID"

"But the MID isn’t just a symbol of housing policy falling prey to plutocracy. It’s a broader moral indictment of the tax code."

"Since tax benefits are most useful for people with taxable income" Yeah, well, duh.

"a 15-story public housing tower and a mortgaged suburban home are both government-subsidized"

Who thinks that the MID is a government subsidy? That the government is paying (already wealthy) people to buy bigger houses?

"It’s not just a failure of housing policy. It's a symbol of everything that’s wrong with the American tax code."

"Federal housing policy transfers lots of money to rich homeowners, a bit less to middle-class homeowners, and practically nothing to poor renters."

"Meanwhile, in 2015, the federal government spent $71 billion on the MID"

"But the MID isn’t just a symbol of housing policy falling prey to plutocracy. It’s a broader moral indictment of the tax code."

"Since tax benefits are most useful for people with taxable income" Yeah, well, duh.

"a 15-story public housing tower and a mortgaged suburban home are both government-subsidized"

Who thinks that the MID is a government subsidy? That the government is paying (already wealthy) people to buy bigger houses?